Community Development Banking News

CDFI Banking: Industry, Policy, and Beyond.

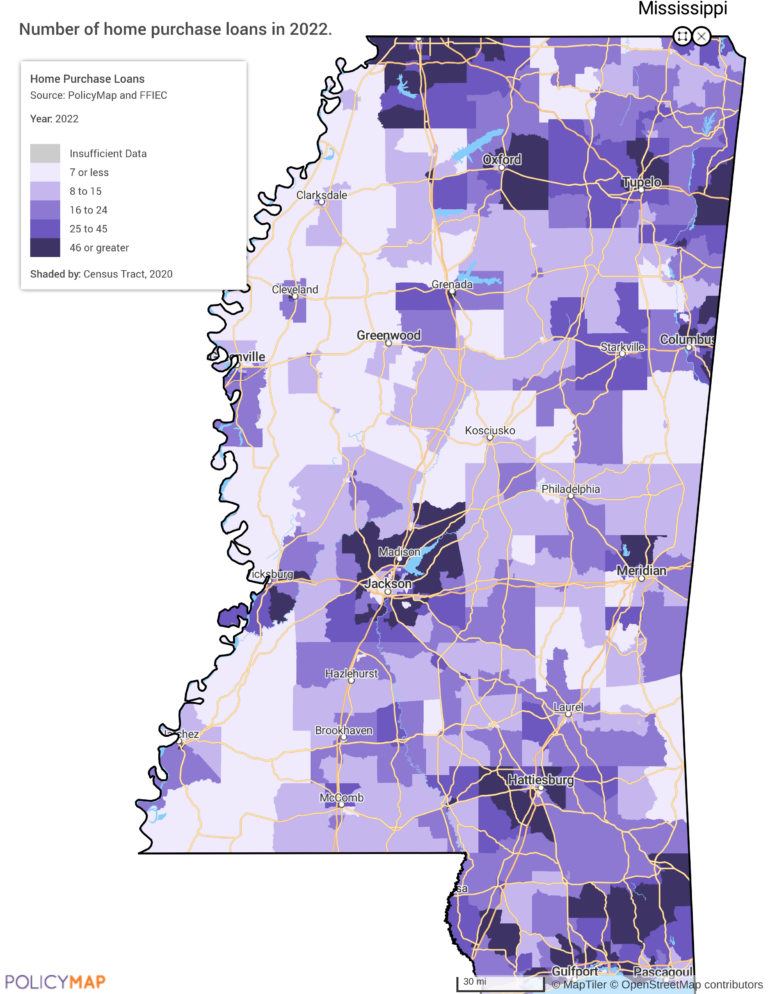

"Community Development Financial Institutions (CDFIs) play a crucial role in providing financial services to low-income communities—areas often overlooked by traditional banks. These mission-driven lenders offer affordable loans to small businesses, schools, grocery stores, daycare centers, and homebuyers who would otherwise struggle to access capital, helping to spur economic growth and stability across the country. Shrinking or defunding CDFIs threatens to dismantle this vital system, cutting off financial access for those who need it most. Without CDFI funding, many will face an even steeper uphill battle to build businesses, secure housing, and create jobs, deepening economic disparities in states already facing significant financial challenges. In this article, we explore, as an example, how CDFIs benefit homebuyers across the state of Mississippi."

"We're so excited to announce that New York State Comptroller Thomas P. DiNapoli and Department of Financial Services Superintendent Adrienne A. Harris have approved our Red Hook Branch as a Banking Development District (BDD) and deposited $10 million in public funds to our bank!

As a community bank in New York, opening our Red Hook branch was a major win for us and the Red Hook community. We're committed to offering affordable and inclusive NY banking solutions to every New Yorker, and as the first bank in Red Hook in over 10 years, we're doing just that. Receiving the BDD designation is another celebratory moment for us. The Department of Financial Services administers this program and supports the establishment of bank and credit union branches in areas across New York State where there is a demonstrated need for banking services."

"The U.S. Department of the Treasury plans to lay off a 'substantial' number of employees as part of the Department of Government Efficiency's effort to shrink the size of the federal government, a department official said in a declaration included in a court filing.

The department is finalizing its plans in response to President Donald Trump's February 11 executive order that directed agency heads to 'undertake preparations to initiate large-scale reductions in force,' according to the declaration from Trevor Norris, the deputy assistant secretary for human resources for the department, first reported by Bloomberg."

"In a series of posts to his account on social media platform X, Federal Housing Finance Agency (FHFA) Director Bill Pulte published housing orders that terminate special purpose credit programs (SPCPs) and rescinds a 2024 advisory bulletin detailing the agency's enforcement against unfair or deceptive acts or practices (UDAP)."

"Two Mississippi banks on Friday announced plans to merge in a deal that would enable the acquirer to bolster its presence in the southern part of the state, where a larger competitor is also bulking up.

BankFirst Capital Corp. said it will acquire The Magnolia State Corp. in a transaction that would create a $3.2 billion-asset company. The deal's financial terms were not disclosed."

"BankPlus and FHLB Dallas awarded Gulf Coast Housing Partnership a $499,000 Affordable Housing Program (AHP) grant toward the construction of 27 affordable apartments, 60 percent of which are specifically set aside for special-needs residents, including people with disabilities and people who are 55 years old and older. The development is a partnership between GCHP and Midtown Partners Inc., the neighborhood-based non-profit that serves the Midtown community."

"The Federal Reserve Board on Friday announced its approval of the application by Renasant Corporation, of Tupelo, Mississippi, to merge with The First Bancshares, and thereby indirectly acquire The First Bank, both of Hattiesburg, Mississippi."

"As we gear up for the 2025 Federal Reserve CDFI Survey, this post paints a picture of the current state of CDFIs and seeks to understand why the industry may look different than it did in 2023, our last survey year. There are several key takeaways:

- The number of CDFIs certified by the CDFI Fund has grown significantly over the last 15 years but decreased slightly since the last iteration of the CDFI Survey in 2023.

- Loan funds and credit unions make up the majority of certified CDFIs, both nationally and within the Fifth District.

- The types of financial institutions that are CDFI-certified has shifted significantly over time, especially as it relates to credit unions, which have doubled in the Fifth District and more than doubled nationally.

- Past survey results illustrate how differences in the business structures of CDFI credit unions and loan funds influence changes in demand and challenges in meeting demand."

"At a time when diversity, equity and inclusion (DEI) are under assault, there is an opportunity to find common ground with community development financial institutions (CDFIs). These institutions—spanning banks, credit unions, loan funds and venture capital providers—serve as crucial lifelines for both urban and rural underserved communities, ensuring that economic opportunities are not just reserved for the privileged few. From financing first-time homeowners and fueling small businesses to investing in vital community infrastructure like health centers and schools, CDFIs are an indispensable force in revitalizing neighborhoods and fostering economic mobility."

"Over the past five years, Carver Federal Savings Bank — the largest publicly-traded, Black-owned bank in the country — has provided $225 million in loans to disadvantaged communities, representing 183 companies.

The bank has created a growing network of businesses and provided a solid stream of institutional and retail deposits. Now, as it heads into its 77th year, Carver is betting a new two-year microloan program will help the iconic Black-owned bank draw more deposits and grants to invest in New York's African American and Caribbean entrepreneurs.

'When we launched it, it was so popular that it almost broke the Internet, because we had so many businesses applying,' jokes 47-year-old Lloyd Doaman, executive director of Carver Community Development Corp, a subsidiary of the bank."