News

"Community development financial institutions (CDFIs) have emerged as pivotal players in bridging financial gaps in underserved communities. Between 2014 and 2024, CDFIs grew sevenfold, reaching $436 billion in assets by the end of 2024.

This growth has enabled CDFIs to serve a growing number of places, especially residents and business owners in Black and Indigenous communities and communities of color. In particular, CDFIs played a critical role in helping business owners of color access vital Paycheck Protection Program dollars during the pandemic, at a time when conventional banks fell short."

"Credit insecurity is regionally concentrated, with concentrations in the South and Appalachia. Credit Insecure places have higher shares of the population who live in rural areas, do not have bachelor's degrees, and rent their homes."

"For the past three decades, a little-known fund housed in the U.S. Department of the Treasury has been quietly fueling economic growth in communities across the country. With an astonishing return on investment, the Community Development Financial Institutions, or CDFI, Fund has unlocked billions in private capital in economically distressed urban, rural and Native communities that are often overlooked by mainstream financial institutions. The CDFI Fund has a 30-year track record of providing resources to local CDFIs — loan funds, credit unions and banks — that finance what is important to Americans with low and moderate incomes: affordable housing; new childcare slots; growth for local businesses; and expanded health care facilities."

"The federal bank regulatory agencies today announced, in light of pending litigation, their intent to issue a proposal to both rescind the Community Reinvestment Act (CRA) final rule issued in October 2023 and reinstate the CRA framework that existed prior to the October 2023 final rule. The agencies will continue to work together to promote a consistent regulatory approach on their implementation of the CRA."

"Yesterday, the United States Senate confirmed Michael Faulkender to be the Deputy Secretary of the United States Department of the Treasury.

'It is an honor to be confirmed as the Deputy Secretary of the United States Department of the Treasury. Thank you, President Trump, for the trust and confidence you have placed in me, and I thank Secretary Scott Bessent for his unwavering support,' said Michael Faulkender. 'I look forward to working with Secretary Bessent in delivering prosperity for the American people, the reprivatization of our economy, national security through economic security, and working to support the President's America First agenda."'

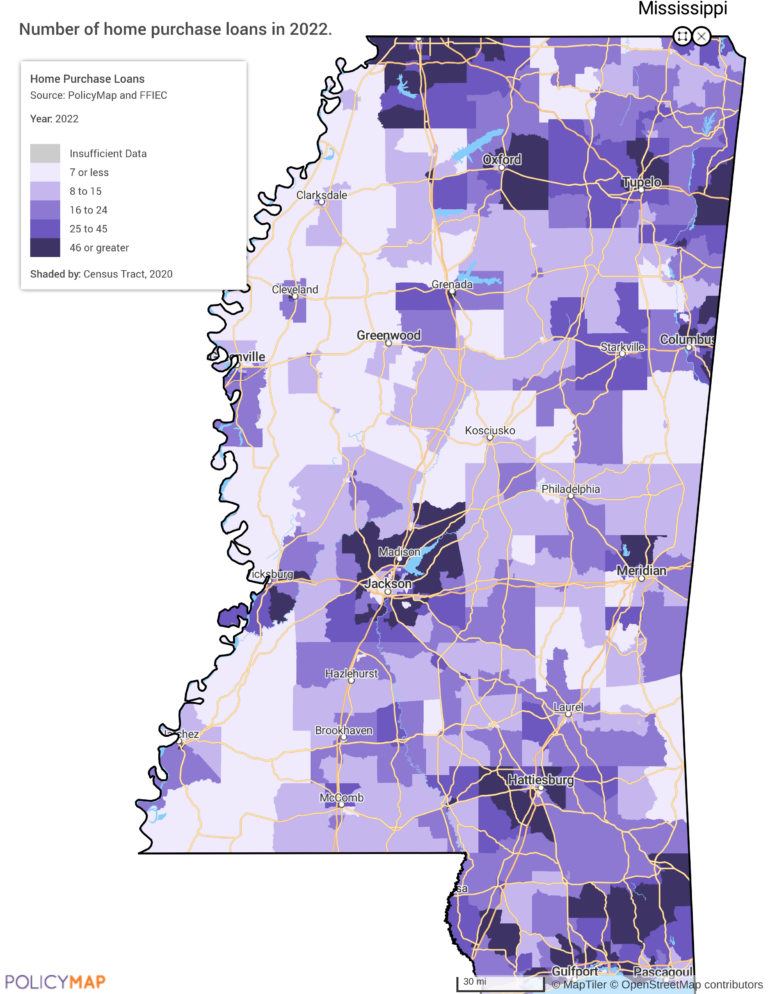

"Community Development Financial Institutions (CDFIs) play a crucial role in providing financial services to low-income communities—areas often overlooked by traditional banks. These mission-driven lenders offer affordable loans to small businesses, schools, grocery stores, daycare centers, and homebuyers who would otherwise struggle to access capital, helping to spur economic growth and stability across the country. Shrinking or defunding CDFIs threatens to dismantle this vital system, cutting off financial access for those who need it most. Without CDFI funding, many will face an even steeper uphill battle to build businesses, secure housing, and create jobs, deepening economic disparities in states already facing significant financial challenges. In this article, we explore, as an example, how CDFIs benefit homebuyers across the state of Mississippi."

"We're so excited to announce that New York State Comptroller Thomas P. DiNapoli and Department of Financial Services Superintendent Adrienne A. Harris have approved our Red Hook Branch as a Banking Development District (BDD) and deposited $10 million in public funds to our bank!

As a community bank in New York, opening our Red Hook branch was a major win for us and the Red Hook community. We're committed to offering affordable and inclusive NY banking solutions to every New Yorker, and as the first bank in Red Hook in over 10 years, we're doing just that. Receiving the BDD designation is another celebratory moment for us. The Department of Financial Services administers this program and supports the establishment of bank and credit union branches in areas across New York State where there is a demonstrated need for banking services."

"The U.S. Department of the Treasury plans to lay off a 'substantial' number of employees as part of the Department of Government Efficiency's effort to shrink the size of the federal government, a department official said in a declaration included in a court filing.

The department is finalizing its plans in response to President Donald Trump's February 11 executive order that directed agency heads to 'undertake preparations to initiate large-scale reductions in force,' according to the declaration from Trevor Norris, the deputy assistant secretary for human resources for the department, first reported by Bloomberg."

"In a series of posts to his account on social media platform X, Federal Housing Finance Agency (FHFA) Director Bill Pulte published housing orders that terminate special purpose credit programs (SPCPs) and rescinds a 2024 advisory bulletin detailing the agency's enforcement against unfair or deceptive acts or practices (UDAP)."

"Two Mississippi banks on Friday announced plans to merge in a deal that would enable the acquirer to bolster its presence in the southern part of the state, where a larger competitor is also bulking up.

BankFirst Capital Corp. said it will acquire The Magnolia State Corp. in a transaction that would create a $3.2 billion-asset company. The deal's financial terms were not disclosed."