News

The U.S. Department of the Treasury's Community Development Financial Institutions Fund (CDFI Fund) opened the fiscal year (FY) 2022 funding round for the CDFI Equitable Recovery Program (CDFI ERP) today. The program will provide approximately $1.73 billion in awards, which was included in the Consolidated Appropriations Act, 2021 (Pub. L. 116-260), to Certified Community Development Financial Institutions (CDFIs) to respond to the economic impact of the COVID-19 pandemic. The CDFI Fund is opening the program round for applications today in anticipation of publication of the Notice of Funds Availability (NOFA) in the Federal Register on June 24, 2022. Through CDFI ERP, the CDFI Fund will provide Awards to Certified CDFIs to 1) expand lending, grant making and investment activities in Low- or Moderate-Income communities and to borrowers, including minorities, that have significant unmet capital or financial services needs and were disproportionately impacted by the COVID-19 pandemic; and 2) enable CDFIs to build organizational capacity and acquire technology, staff, and other tools necessary to accomplish the activities under a CDFI ERP Award. All Awards provided through this NOFA are subject to funding availability. The CDFI ERP Award may be expended for eligible activities such as financial products, financial services, development services and/or grants, and certain operational support activities as defined by the NOFA. All applications must be submitted to the CDFI Fund by August 23, 2022.

Mary Holmes, a retired resident of Jackson, Mississippi, is living comfortably in her home again after receiving funding from the Special Needs Assistance Program (SNAP) to replace her roof. After years of uncertainty about how she could afford to replace her aging roof, Ms. Holmes received a $7,000 SNAP subsidy from BankPlus and the Federal Home Loan Bank of Dallas (FHLB Dallas). The roof was leaking and in desperate need of replacement. “I’ve lived in this home for 42 years. It was brand new when I moved in, but as time has gone on, repairs have been needed and it is hard to do that while living on a fixed income,” Ms. Holmes said. Mark Ouellette, first vice president at BankPlus, said keeping residents comfortable and safe within their homes is a priority for the bank. “Many of our customers have owned their homes for decades and, as repairs come up, we are honored to be able to help secure funding for them through SNAP and are grateful for our partnership with FHLB Dallas to make that happen,” he said.

BankFirst Capital Corp. in Columbus, Mississippi, agreed to acquire in-state peer Tate Financial Corp., parent of the $330 million-asset Sycamore Bank in Senatobia. The $2 billion-asset BankFirst would gain about $160 million of loans and more than $300 million of deposits in Mississippi, according to Federal Deposit Insurance Corp. data. "Together, the combined company will have over 256 years of community banking experience in Mississippi," BankFirst President and CEO Moak Griffin said in a press release Thursday. "We expect this merger to enhance our ability to continue investing in our products and services, ensuring that we remain competitive on all fronts as the banking industry continues to change and evolve," Griffin added.

In late 2021 the Federal Reserve Bank of San Francisco kicked off a series of roundtable discussions on climate change-related risks with community development professionals who work in low- and moderate-income (LMI) communities and communities of color. Our most recent roundtable focused on understanding the impact of climate risk on Community Development Financial Institutions (CDFIs) and the important work they do in LMI communities. Participants included real estate lenders and small business and consumer lenders serving urban, rural, and Tribal communities. Here's what we heard.

Yesterday, the CDFI Fund released the FY2021 Capital Magnet Fund (CMF) award announcement, awarding over $336 million to 32 CDFIs and 27 Nonprofit Housing Organizations. This year: Three CDFI banks or bank holding companies and one CDFI bank affiliate received awards: Beneficial State Bancorp, Inc.; Central Bank of Kansas City; City First Enterprises, Inc.; and Legacy Bank & Trust Company; of the three CDFI banks or bank holding companies and one CDFI bank affiliate, all were either CDBA members or affiliated with a CDBA member; collectively, these banks increased their awards by $4.9 million over their previous award amounts; a total of 146 organizations applied for the FY2021 round requesting more than $991 million in CMF awards. Of those applicants, three were banks or thrifts and two were depository institution holding companies.

A new bill in Congress proposes a tax credit to subsidize long-term investments in financial institutions that have a primary mission to serve low- and moderate-income communities. The bipartisan Community Development Financial Institutions Tax Credit Act was introduced by U.S. Sen. Mark R. Warner of Virginia along with Sens. Roger Wicker and Cindy Hyde-Smith of Mississippi and Chris Van Hollen of Maryland. The legislators say the tax credit would "promote lasting economic prosperity in Black, brown and low-income communities." The proposed tax credit would subsidize equity investments into the 1,400 financial institutions that the U.S. Treasury Department has certified as Community Development Financial Institutions, or CDFIs. To be certified, CDFIs must report that at least 60% of their annual lending and other business is in low- and moderate-income areas or with low- or moderate income borrowers.

The Harbor Bank of Maryland had a grand opening of their Northwood Branch this week. They took it as a perfect opportunity to celebrate Juneteenth. It's opening up in Northwood Commons Shopping Center, which played an important role during the Civil Rights movement. 400 students from Morgan State University protested the center's segregation and wound up in jail. Now it's been transformed to reflect the spirit of those 400 students and the work they did to fight for their rights.

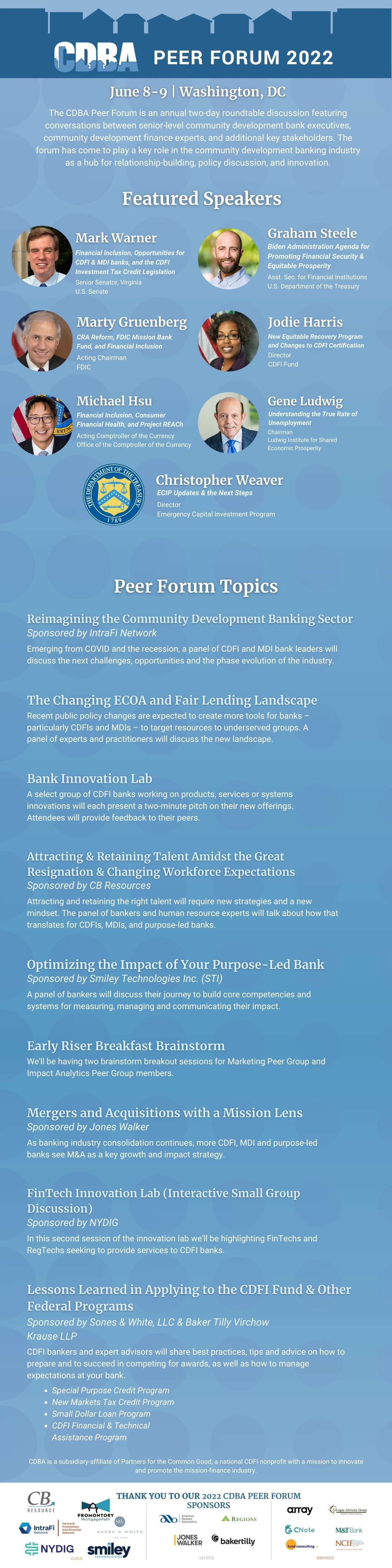

Senator Mark Warner, Senate Colleagues and Community Development Bankers Association (CDBA) Steward Historic Bi-Partisan Legislation

WASHINGTON – Today, U.S. Sen. Mark R. Warner (D-VA) was joined by Sens. Roger Wicker (R-MS), Chris Van Hollen (D-MD), and Cindy Hyde-Smith (R-MS) in introducing bipartisan legislation to promote lasting economic prosperity in Black, brown and low-income communities. This bill would help unlock more equity and long-term financial capital for community development financial institutions (CDFIs). CDFIs serve as a backbone for low-income or minority-owned businesses, which tend to have fewer banking relationships and less access to traditional forms of funding.

This bill will help direct support to lenders that focus on underserved communities. It creates a CDFI Investment Tax Credit that will attract private sector investors that make equity, equity-equivalent investments, or long-term patient capital available to CDFIs. The bill will benefit CDFIs of all types including banks, credit unions, venture capital funds, and loan funds, while providing institutions with the maximum flexibility and financial support they need to increase wealth in low- and moderate-income communities. Currently, there are 1,400 CDFIs nationwide.

“As the national trade association for community development banks, CDBA is proud to have led the advocacy efforts for the new CDFI Tax Credit Investment Act. In addition to another recent victory for the communities served by CDFI banks – the U.S. Treasury’s $9 Billion Emergency Capital Investment Program (ECIP) – this tax credit will strengthen CDFIs serving at the grassroots, supporting the most vulnerable and disinvested communities in the U.S. and creating new economic opportunities. This tool will be a game changer by attracting private capital to Main Street where it’s needed most.'' said Jeannine Jacokes, Chief Executive Officer, Community Development Bankers Association.

To combat the hemorrhaging of jobs and economic opportunities during the pandemic, Sen. Warner has been a leader in Congress for CDFIs and MDIs. In July of 2020, he teamed up with a bipartisan group of Senators to introduce the Jobs and Neighborhood Investment Act – an effort that secured endorsements from a host of other advocacy organizations and civil rights groups. Together, Sen. Warner and U.S. House Financial Services Committee Chairwoman Maxine Waters were later able to secure provisions from the bill in the Coronavirus Response and Relief Supplemental Appropriations Act of 2021, which was signed into law on December 27, 2020, providing an unprecedented $12 billion in...

Last week, the House Appropriations released a draft of FSGG appropriations bill for FY 23. The FSGG Appropriations Subcommittee was scheduled to mark-up the bill June 16. Full Committee consideration is scheduled for tomorrow, June 24, with floor consideration soon thereafter. The Senate Appropriations Committee has not yet released a mark-up schedule. The bill appropriations $336.4 million for the CDFI Fund. The amount is $41 million higher than Fiscal Year 2022 and approximately $5 million above the budget request. The bill also authorized $500 million for the CDFI Bond Guarantee. As is past years, the bill directs the Fund to prioritize Financial Assistance awards to organizations lending and investing in high poverty areas – census tracts with poverty rates of at least 20 percent over the period of 2016-2020. The bill also continues to waive matching requirements for the NACA program.