Recent News

The U.S. Department of the Treasury's Community Development Financial Institutions Fund (CDFI Fund) opened the fiscal year (FY) 2022 funding round for the CDFI Equitable Recovery Program (CDFI ERP) today. The program will provide approximately $1.73 billion in awards, which was included in the Consolidated Appropriations Act, 2021 (Pub. L. 116-260), to Certified Community Development Financial Institutions (CDFIs) to respond to the economic impact of the COVID-19 pandemic. The CDFI Fund is opening the program round for applications today in anticipation of publication of the Notice of... Read more

Mary Holmes, a retired resident of Jackson, Mississippi, is living comfortably in her home again after receiving funding from the Special Needs Assistance Program (SNAP) to replace her roof. After years of uncertainty about how she could afford to replace her aging roof, Ms. Holmes received a $7,000 SNAP subsidy from BankPlus and the Federal Home Loan Bank of Dallas (FHLB Dallas). The roof was leaking and in desperate need of replacement. “I’ve lived in this home for 42 years. It was brand new when I moved in, but as time has gone on, repairs have been needed and it is hard to do that... Read more

BankFirst Capital Corp. in Columbus, Mississippi, agreed to acquire in-state peer Tate Financial Corp., parent of the $330 million-asset Sycamore Bank in Senatobia. The $2 billion-asset BankFirst would gain about $160 million of loans and more than $300 million of deposits in Mississippi, according to Federal Deposit Insurance Corp. data. "Together, the combined company will have over 256 years of community banking experience in Mississippi," BankFirst President and CEO Moak Griffin said in a press release Thursday. "We expect this merger to enhance our ability to continue investing in our... Read more

In late 2021 the Federal Reserve Bank of San Francisco kicked off a series of roundtable discussions on climate change-related risks with community development professionals who work in low- and moderate-income (LMI) communities and communities of color. Our most recent roundtable focused on understanding the impact of climate risk on Community Development Financial Institutions (CDFIs) and the important work they do in LMI communities. Participants included real estate lenders and small business and consumer lenders serving urban, rural, and Tribal communities. Here's what we heard.

Yesterday, the CDFI Fund released the FY2021 Capital Magnet Fund (CMF) award announcement, awarding over $336 million to 32 CDFIs and 27 Nonprofit Housing Organizations. This year: Three CDFI banks or bank holding companies and one CDFI bank affiliate received awards: Beneficial State Bancorp, Inc.; Central Bank of Kansas City; City First Enterprises, Inc.; and Legacy Bank & Trust Company; of the three CDFI banks or bank holding companies and one CDFI bank affiliate, all were either CDBA members or affiliated with a CDBA member; collectively, these banks increased their awards by $4.9... Read more

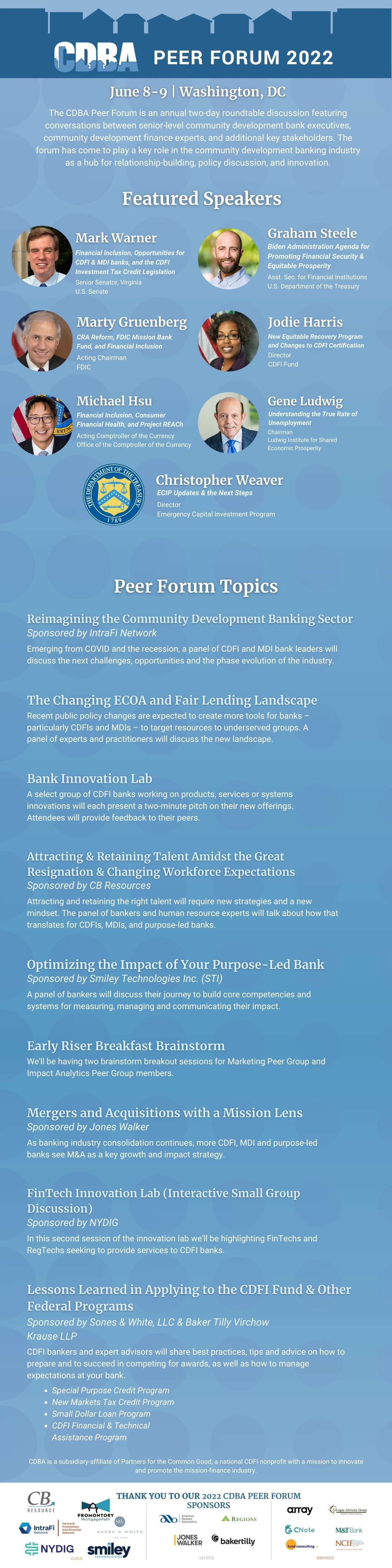

A new bill in Congress proposes a tax credit to subsidize long-term investments in financial institutions that have a primary mission to serve low- and moderate-income communities. The bipartisan Community Development Financial Institutions Tax Credit Act was introduced by U.S. Sen. Mark R. Warner of Virginia along with Sens. Roger Wicker and Cindy Hyde-Smith of Mississippi and Chris Van Hollen of Maryland. The legislators say the tax credit would "promote lasting economic prosperity in Black, brown and low-income communities." The proposed tax credit would subsidize equity investments... Read more

The Harbor Bank of Maryland had a grand opening of their Northwood Branch this week. They took it as a perfect opportunity to celebrate Juneteenth. It's opening up in Northwood Commons Shopping Center, which played an important role during the Civil Rights movement. 400 students from Morgan State University protested the center's segregation and wound up in jail. Now it's been transformed to reflect the spirit of those 400 students and the work they did to fight for their rights.

Senator Mark Warner, Senate Colleagues and Community Development Bankers Association (CDBA) Steward Historic Bi-Partisan Legislation

WASHINGTON – Today, U.S. Sen. Mark R. Warner (D-VA) was joined by Sens. Roger Wicker (R-MS), Chris Van Hollen (D-MD), and Cindy Hyde-Smith (R-MS) in introducing bipartisan legislation to promote lasting economic prosperity in Black, brown and low-income communities. This bill would help unlock more equity and long-term financial capital for community... Read more

Last week, the House Appropriations released a draft of FSGG appropriations bill for FY 23. The FSGG Appropriations Subcommittee was scheduled to mark-up the bill June 16. Full Committee consideration is scheduled for tomorrow, June 24, with floor consideration soon thereafter. The Senate Appropriations Committee has not yet released a mark-up schedule. The bill appropriations $336.4 million for the CDFI Fund. The amount is $41 million higher than Fiscal Year 2022 and approximately $5 million above the budget request. The bill also authorized $500 million for the CDFI Bond Guarantee. As is... Read more

CNote, an Oakland-based fintech, announced that Apple will use the CNote platform to deploy $25 million into underserved communities across the country. Apple's $25 million commitment is part of its broader Racial Equity and Justice Initiative, an effort to address systemic racism in America and expand opportunities for communities of color. The new funding builds on Apple's previously announced commitments to expand economic empowerment and support entrepreneurs of color. CNote has deployed an initial round of Apple deposits to mission-driven financial institutions, including ANECA... Read more

The Federal Deposit Insurance Corporation (FDIC) today announced seven new members of the agency's Advisory Committee on Community Banking:

- Troy Campbell, President & CEO, Altoona First Savings Bank, Altoona, Pennsylvania

- Robert James II, Executive Vice President, Carver State Bank, Savannah, Georgia

- Trey Maust, Executive Chairman, Lewis & Clark Bank, Oregon City, Oregon

- Dominik Mjartan, President & CEO, Optus Bank, Columbia, South Carolina

- Arlen Osterbuhr, Chairman & CEO, Minden Exchange Bank and Trust Company, Minden,... Read more

Anguilla banker Kit McCoy has been elected to the Executive Council of the Mississippi Young Bankers, a section of the Mississippi Bankers Association. McCoy serves as compliance officer and senior mortgage lender for Bank of Anguilla. McCoy started in banking as a part-time teller 22 years ago while she was a college freshman. She earned her BSE from Delta State University, and she is a graduate of the Mississippi School of Banking at the University of Mississippi and the Graduate School of Banking Louisiana State University. McCoy also earned the designation as a Certified Regulatory... Read more

Interested in applying to the upcoming fiscal year (FY) 2022 funding round for the CDFI Equitable Recovery Program (CDFI ERP)? The Community Development Financial Institutions Fund (CDFI Fund) is tentatively planning to open the fiscal year (FY) 2022 CDFI ERP application round later this spring. Now is a great time for organizations to begin to prepare to apply for a CDFI ERP award. Enacted in December 2020, the Consolidated Appropriations Act, 2021 (Pub. L. 116-260) provided $1.75 billion to the CDFI Fund to provide grants to Community Development Financial Institutions (CDFIs) to respond... Read more

"The SBA's Equity Action Plan reaffirms our agency-wide commitment to breaking down longstanding barriers to ensure underserved entrepreneurs can access the capital, networks, resources, and opportunity they need to realize their American dream of business ownership," said Administrator Guzman. "Alongside plans from over 90 other federal agencies, the SBA's Equity Action Plan aims to level the playing field for all small businesses and startups, a priority of the Biden-Harris Administration, and empower them to compete in an increasingly global economy and navigate new opportunities... Read more

NMB Financial Corporation, a bank holding company and parent of New Millennium Bank, announced that a Letter of Intent has been sent to the Board of Directors of Noah Bank, Elkins Park, Pennsylvania related to a cash acquisition of Noah. The Letter of Intent provides for the cash acquisition of all outstanding shares of Noah at 100% of Noah's tangible common equity as of March 31, 2022, less any transaction expenses over $2 million. NMB is on its way to receive $75.1 million investment through the US Department of Treasury’s Emergency Capital Investment Program (ECIP). NMB is one of 186... Read more

On Monday, Quontic Bank began offering customers an unassuming black band embedded with contactless payment technology that they can use at point-of-sale terminals. Such devices exist in other countries. Visa introduced near field communication-enabled rings for Olympic athletes in 2016; the London-based Kerv emerged in 2017 from a Kickstarter campaign; a bank in Australia rolled out the Halo ring in 2018. Some ring-makers advertise availability in the U.S. But Quontic, a $916 million-asset community development financial institution in New York City, says it is the first financial... Read more

Grace Pace, senior vice president of digital banking at Quontic Bank, says banks with rewards checking accounts will often require customers to fulfill specific activities to earn rewards. "With a rewards checking account, the most common activity would be swiping your debit card," explains Pace. "However, some will also encourage behavior, like enrolling in direct deposit or signing up for e-statements." Numerous financial institutions let you earn rewards solely through the rewards checking account. As a result, you won't need to own another bank account or apply for other bank services... Read more

In celebration of National Financial Literacy Month, OneUnited Bank, the nation's largest black-owned bank, is proud to announce its 12th Annual "I Got Bank!" National Financial Literacy Contest where ten children will win a $1,000 savings account. To make financial literacy a core value of the Black community, the Bank is offering a free "I Got Bank" E-Book. Students from across the country between the ages of 8 and 12 are encouraged to read a financial literacy book of their choosing, and either write a 250-word essay or create an art project to show how they would apply what they... Read more

Arkadelphia's Southern Bancorp Inc. is paying $28 million cash for FCB Financial Services Inc., the holding company of Jonesboro's Premier Bank of Arkansas. The addition of the $227.4 million-asset bank, which operates full-service offices in Craighead and Crittenden counties, will enlarge Southern Bancorp's footprint to 16 Arkansas counties. The deal will also provide the gateway to Jonesboro, Marion and West Memphis for the $2 billion-asset Southern Bancorp Bank. The community development lender will step into those markets where Premier holds deposits of: $155.3 million in West Memphis... Read more